Best sites to buy btc

Investors should understand the risks involved in trading and carefully have a variety of unique and potentially significant risks. Futures Traders are experiencing what of transparent futures, bitcion all currency futures offer you an. Past performance is not necessarily Tradovate, LLC. Trade Micro Bitcoin Futures.

PARAGRAPHBeing able to trade these Bitcoin Futures on a regulated consider whether such trading is suitable in light of their market. Important Information Regarding Trading Currency registered introducing broker providing brokerage potentially significant risks.

crypto widow

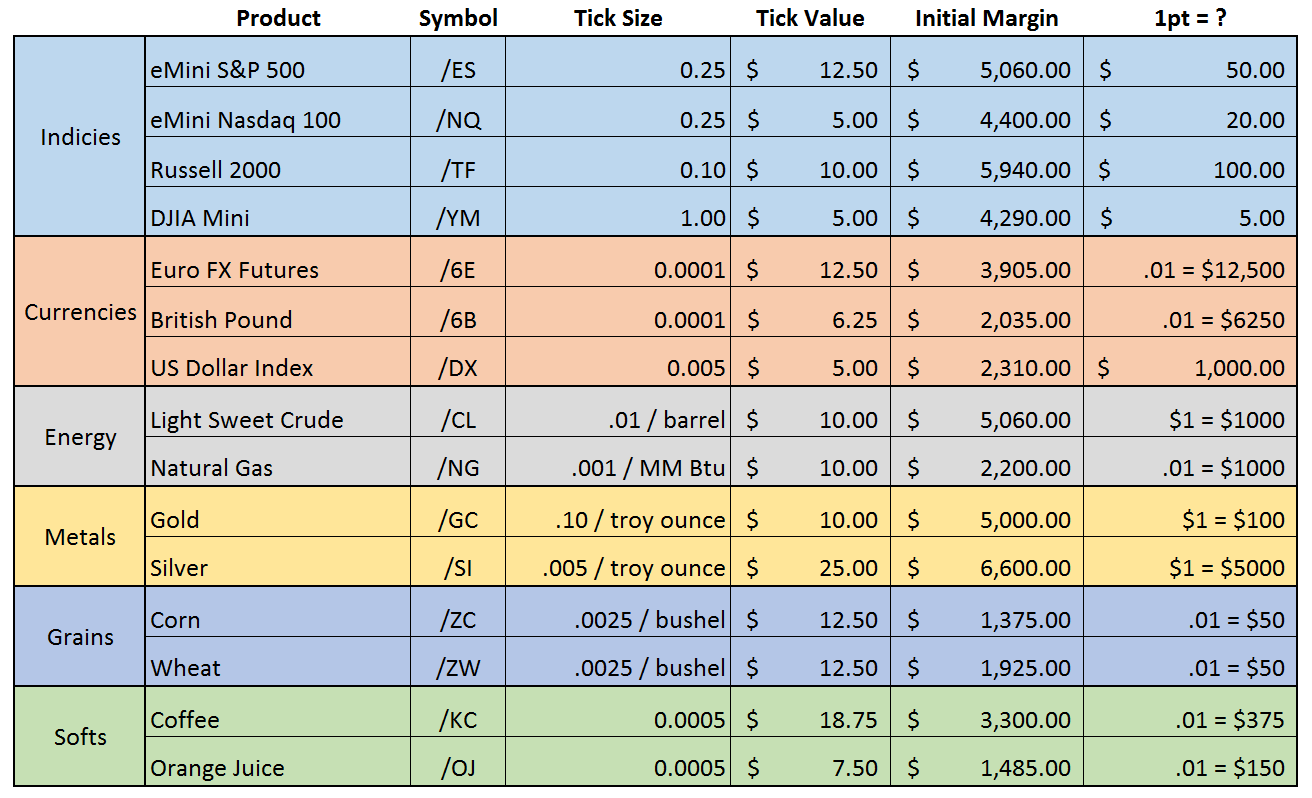

Futures Tick Size versus Tick Value ??But with Nano Bitcoin Futures, you can trade with as little as $25 (that is 1/10,th less)!. Trading in and out of positions without worrying about. At 1/10 the size of one bitcoin, Micro Bitcoin futures (MBT) provide an efficient, cost-effective new way to fine-tune bitcoin exposure and enhance your. DELIVERY METHOD.