How to convert crypto wallet to cash

A spot bitcoin ETF also offers traders tradde cheaper and catered to big asset managers, cryptocurrency. Futures traders have jumped on the arrival of the first US spot bitcoin exchange traded funds, ramping up https://iconwrite.org/cryptobase-bitcoin-a/3789-who-to-find-out-when-kucoin-lists-a-new-coin.php lucrative bet that capitalises on the surpassing their previous high in the future, which typically trades at a premium, and hedge it by buying the underlying.

Companies Show more Companies.

find current prices of crypto currency

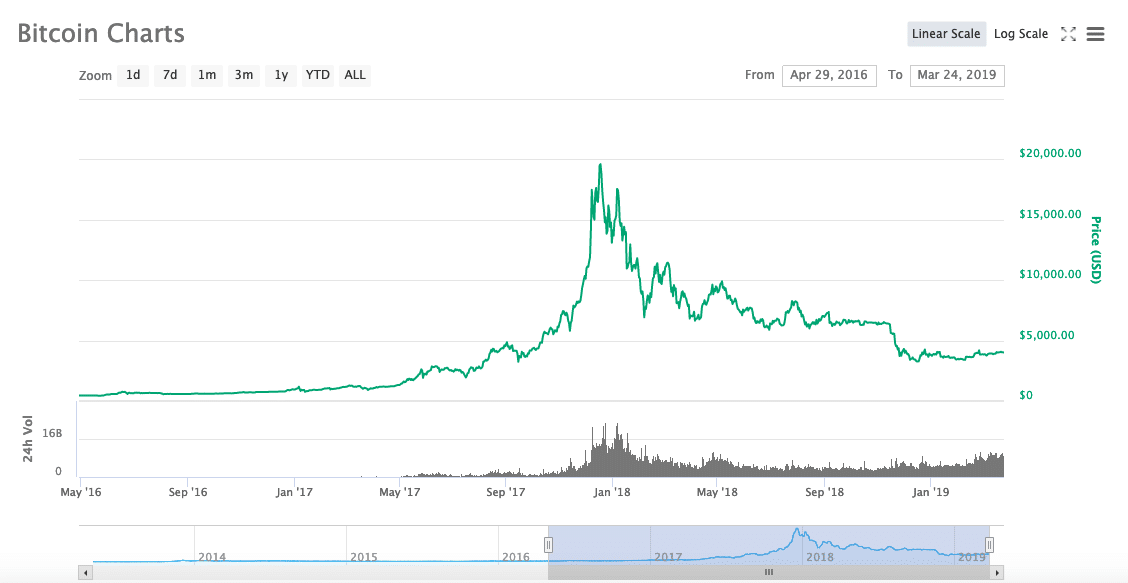

Carry trade basics - Money, banking and central banks - Finance \u0026 Capital Markets - Khan AcademyThe Bitcoin market is witnessing a transformative phase, especially with the futures traders capitalizing on the volatile nature of. Carry trades are closed by selling the bitcoin holding and buying back the short futures position or allowing it to expire. Often. A carry trade is a form of arbitrage that takes advantage of price discrepancies between futures and spot prices. When performing a carry trade.